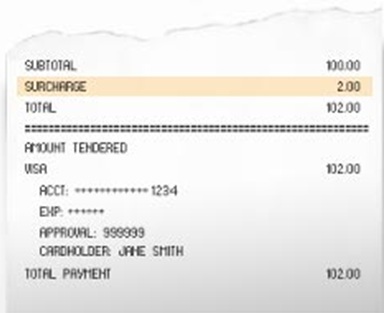

A few months ago I went to a different barbershop to get a haircut; my regular barber was booked up and I really needed a haircut, so I went to one close to my home. After the nice stylish haircut I got, I pulled out my debit card to pay and to my surprise the cashier at the barbershop told me that I would have to pay an additional $2 dollars if I used a credit or debit card. I had no cash on me and had to use my debit card. I was pretty pissed off and swore that I would never do business with that barbershop again, which happens to be a very popular barbershop in Charlotte, NC. For this blog I will leave them nameless.

It was not until I went to another merchant months later; in which they also tacked on an extra surcharge to my purchase that I said enough with this! I am personally going to find out what my rights are as a consumer.

I did a little research and boy was I very pleased to find that these practices are prohibited by most credit card companies. If you fall victim to credit or debit card checkout fees or surcharges you have rights and you should use them. The credit card issuers like VISA, MasterCard and American Express are our allies and will help you.

What Can We Do To Stop This?

All we have to do is pick up the phone or get on the Internet and report them! If the merchant is found out to be violating the terms of using credit card issuers terms they could end up losing their credit and debit card processing privileges and/ or pay fines.

In a nutshell a merchant cannot charge you anymore for a product or service that you would pay with cash if you use a credit or debit card. Now a merchant can offer to give you a discount from normal prices if you pay with cash. I think that is fair.

You see technology has helped many businesses make more money and get sales they would normally loose because technology makes it easy to access your cash or credit 24 hours a day and not have to go to the bank and stand in line to get cash. Some business owners do not get it! Credit and debit cards make you more revenue. Merchants do this because the get charged a very small percentage or flat fee to process the credit or debit card so that the money gets safely transferred into their business bank account. Additionally, I see this happening much to often in urban cites; especially in Black communities. After reading my blog we can put an end to this ridiculousness!

It was not until I went to another merchant months later; in which they also tacked on an extra surcharge to my purchase that I said enough with this! I am personally going to find out what my rights are as a consumer.

I did a little research and boy was I very pleased to find that these practices are prohibited by most credit card companies. If you fall victim to credit or debit card checkout fees or surcharges you have rights and you should use them. The credit card issuers like VISA, MasterCard and American Express are our allies and will help you.

What Can We Do To Stop This?

All we have to do is pick up the phone or get on the Internet and report them! If the merchant is found out to be violating the terms of using credit card issuers terms they could end up losing their credit and debit card processing privileges and/ or pay fines.

In a nutshell a merchant cannot charge you anymore for a product or service that you would pay with cash if you use a credit or debit card. Now a merchant can offer to give you a discount from normal prices if you pay with cash. I think that is fair.

You see technology has helped many businesses make more money and get sales they would normally loose because technology makes it easy to access your cash or credit 24 hours a day and not have to go to the bank and stand in line to get cash. Some business owners do not get it! Credit and debit cards make you more revenue. Merchants do this because the get charged a very small percentage or flat fee to process the credit or debit card so that the money gets safely transferred into their business bank account. Additionally, I see this happening much to often in urban cites; especially in Black communities. After reading my blog we can put an end to this ridiculousness!

What is a Checkout Fee?

Photo Credit: VISA.com

Learn more about Visa & MasterCard Checkout Fees & Rules:

Mastercard Merchant Manual

VISA Warns Consumers about Retailer Checkout Fees

A merchant must not directly or indirectly require any MasterCard cardholder to pay a surcharge or any part of any merchant discount or any contemporaneous finance charge in connection with a MasterCard card transaction. A merchant may provide a discount to its customers for cash payments. A merchant is permitted to charge a fee (such as a bona fide commission, postage, expedited service or convenience fees, and the life) if the fee is imposed on all like transactions regardless of the form of payment used.

* A surcharge is any fee charge in connection with a MasterCard transaction that is not charged if another payment method is used.

* The merchant discount fee is the fee the merchant pays to its acquirer to acquire transactions.

A merchant must not require, or post signs indicating that it requires, a minimum or maximum transaction amount to accept a valid MasterCard card.

What to Do if You Are Charged Checkout Fees?

If you run across a merchant who adds on extra charges to use your credit card report them!

Report MasterCard Merchants (See Section Titled: 9.12.3 Minimum/Maximum Transaction Amount Prohibited)

Report VISA Merchants

State No Surcharge Laws Protect Consumers

Consumers who are subjected to checkout fees in states where they are protected by law may report the retailer to their state attorney general's office.

10 States also Protect Consumers with No Surcharge Laws

In 10 states it is prohibited by law for retailers to charge consumers a fee for using a credit card (California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma and Texas). Consumers who are subjected to checkout fees in states where they are protected by law may report the retailer to their state attorney general's office.

Click a state below to read the laws on surcharging and find out where you can go if you suspect a violation.

State Laws & Attorney General Contact InformationCalifornia

- COLORADO

- Connecticut

- Florida

- Kansas

- Maine

- Massachusetts

- New York

- Oklahoma

- Texas

Be safe out there being a consumer; peace!

Julius

These blog is really excellent to share with us. Master Card card holder to pay a surcharge or any part of any merchant discount or any contemporaneous finance charge in connection with a Master Card card transaction.

ReplyDeleteCredit Cards are not cash. My little corner grocery store pays about $1100.00 per month for $25,000 in credit sales. I charge .50 cents below $5.00 and .25 cents above $5.00; about half what it costs me. Don't want to pay a surcharge? Pay cash.

ReplyDeleteGet over your sense of entitlement; there is no free lunch